This Week in a Nutshell (5th – 9th September)

Technical talks

NIFTY opened the week on 5th September at 17,546 and closed at 17,833 on 9th September. The index made a weekly gain of 1.7% during the week. On the upside, the upper Bollinger band level of 18,199 might act as a resistance. On the downside, it can take support at the 50-week moving average near 17,137. Even though the RSI of 60 does suggest some caution, in the recent past NIFTY has comfortably traded at a 60+ RSI level.

Among the sectoral indices, PSU BANK (+4.3%), IT (3.5%), and MEDIA (3.2%) led the gainers during the week. AUTO was the only sector that ended marginally in the red.

Weekly highlights

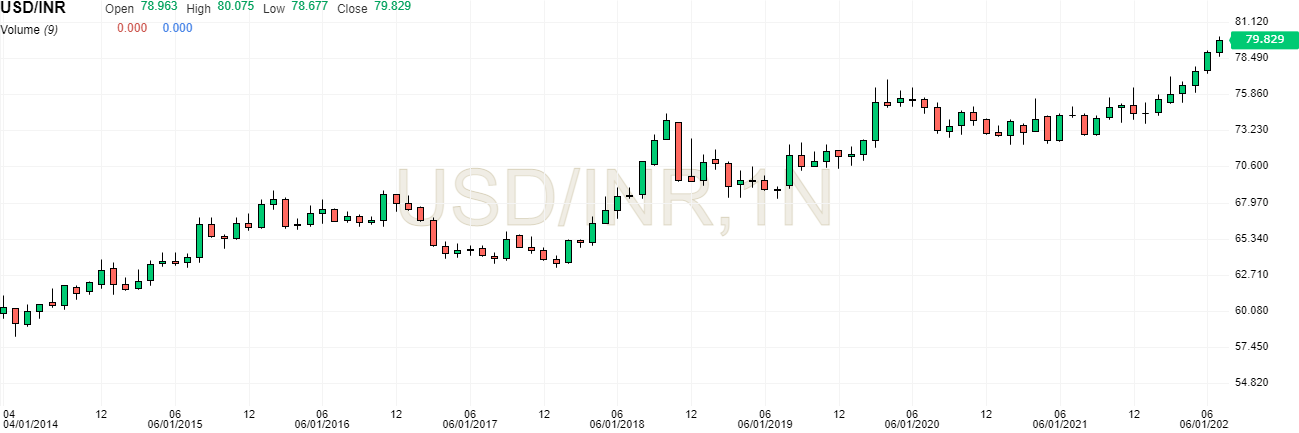

- The US indices snapped a three-week losing streak despite remarks from the Federal Reserve officials on rising treasury yields. Geopolitical tensions and the US central bank’s aggressive tightening may tip the US economy into recessions were on investors’ minds during the volatile week. The US markets had a truncated week due to Labor Day weekend with the tech stocks and blue chips leading the rally. NASDAQ closed up 4.1%, S&P 500 up ~3.7%, and Dow Jones Industrial Average up ~2.7%.

- Crude oil prices also remained volatile during the week with the OPEC+ meeting on Monday 5th. To support oil prices, which have fallen due to concerns about an economic downturn, OPEC and its partners, led by Russia, decided on a modest reduction in production. For October, the oil producers will reduce their output by 100,000 barrels per day (bpd), or just 0.1% of the world’s demand. They also concurred that Saudi Arabia, the organization’s dominant member, could call an emergency meeting at any time if volatility continues. Price hikes due to the output reduction would worsen India’s current account deficit.

- The volatility in crude prices continued after reports that the Biden administration might stop releasing barrels from the US Strategic Petroleum Reserve on the market after October, in an attempt to keep energy prices down that have led to unprecedented inflation. Brent Oil ended the week at USD 92.4/barrel (-0.7%) while Crude Oil WTI (West Texas Intermediate) ended the week down 2.4% at USD 86.1/barrel.

- After Russia announced that one of its key gas supply pipelines to Europe will remain closed indefinitely, gas prices in Europe increased by 30% on Monday. A leak in the Nord Stream 1 pipeline, according to Russia, will cause it to remain closed beyond the three days of scheduled repair last week.

- In India, FADA released the data for retail sales of automobiles for August-22. The sales grew 8.3% YoY driven by an increase in vehicle registrations across all major segments. Two-wheeler retail sales grew 8.5% YoY while passenger vehicle sales grew ~6.5% YoY.

- The National Company Law Tribunal (NCLT) Mumbai panel directed Zee Entertainment to call a shareholders’ meeting on October 14 to approve the merger with Culver Max Entertainment on Wednesday (formerly Sony Pictures Network).

- To increase domestic supply in response to a decline in the area under the paddy crop in the current Kharif season, the Indian Government implemented a 20 percent export levy on all non-Basmati rice, with the exception of parboiled rice.

- The Foreign Institutional Investors (FII) purchased equities worth Rs 61,367mn. Domestic Institutional Investors (DII) sold shares worth Rs 3,521 mn.

Things to watch out for next week

- Global markets will watch out for the US inflation numbers expected to be released on Tuesday 13th, ahead of the Federal Reserve policy meeting on September 20-21.

- Indian investors’ attention would be on the consumer price index (CPI) inflation numbers for August, before the monetary policy meeting scheduled to be held towards the end of September. The industrial production data for July and wholesale price index (WPI) inflation for August is also expected to be released in week starting 12th.

Disclaimer: “The views expressed are for information purposes only. The information provided herein should not be considered investment advice or research recommendation. The users should rely on their own research and analysis and should consult their own investment advisors to determine the merit, risks, and suitability of the information provided.”

Update on the Indian Equity Market:

Update on the Indian Equity Market: