The Impact of Rupee Depreciation

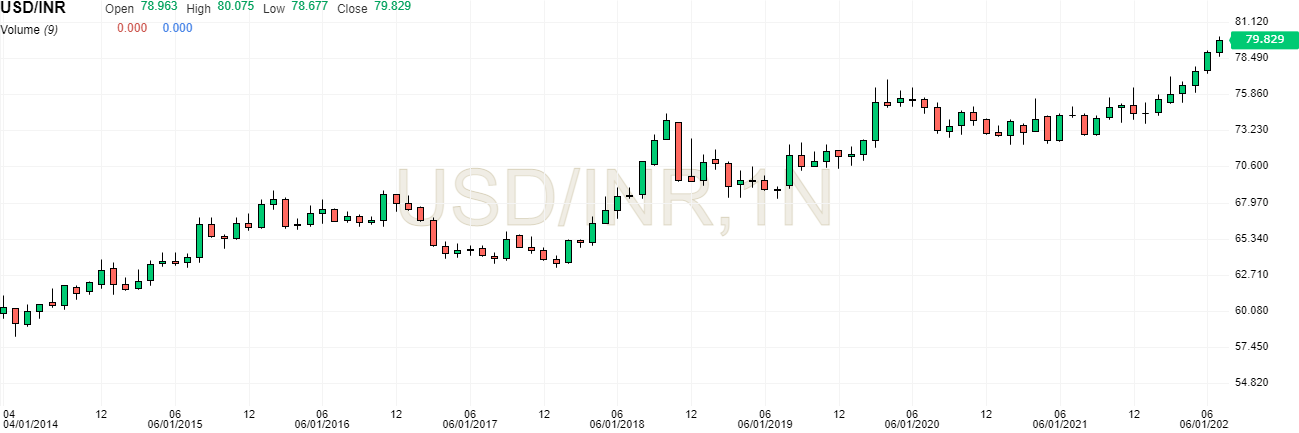

The rupee has been on a downward spiral since January 2022 (-6.28%) leading to negative market sentiments. It settled at a fresh low of ₹79.64 on 13th July, 34 paise away from ₹80. Rising crude oil prices, a strengthening Dollar Index, and huge amounts of FII (Foreign Institutional Investors) outflows in Indian markets are the primary reasons for the depreciation of the rupee.

Source: Trading View

What does the depreciation of a currency exactly mean?

Currency depreciation is the loss of a currency’s value in terms of its exchange rate versus other currencies. It specifically refers to currencies with a floating exchange rate, which is a system in which the value of a currency is determined by the forex market based on supply and demand. For example, if the value of 1 USD changes from ₹75 to ₹80, the change will be termed ‘depreciation’ of the rupee.

How does this impact import?

India, as a net importer, relies heavily on imported goods to meet its needs. Imported goods become more expensive due to depreciation in the value of the rupee leading to inflationary environments. India imports 80% of its crude oil and this has a multiplier effect on the prices of fuel – diesel, petrol, and cooking gas – which are already high.

Industries like oil and gas, paints, food, and beverages that depend on imports for their raw material needs suffer when the currency depreciates. Elevated commodity prices tend to dent the profitability of these companies. Industries usually pass on these elevated prices to customers to reduce the hit on profitability.

How does this impact export?

From a revenue perspective, industries like Pharma and IT benefit when the currency depreciates as companies earn more rupees while exchanging dollars. Pharma companies with subsidiaries outside of India tend to report higher consolidated margins because higher cost inventory translates into lower operating expenses.

Current Account Deficit widens

Current Account Deficit (CAD) is a measurement where a country’s imports of goods and services exceed its exports. A depreciating currency coupled with elevated commodity prices tends to inflate the CAD due to expensive imports and force the central bank to dip into its forex reserves to finance the deficit. India’s CAD widened to a record high of $25 billion in June from $24 billion in May. On a quarterly basis, the gap increased 122.8% in the June quarter to $70 billion from $31 billion in the year-ago period.

Source: RBI Website

How does the RBI intervene?

When the value of a country’s domestic currency tumbles, the central bank intervenes by selling its foreign reserves, causing capital outflow. This aids in curtailing the arresting in the value of the domestic currency. According to the RBI’s Weekly Statistical Supplement, the RBI sold $5 billion in foreign exchange reserves during the week of July 1, 2022, reducing the overall reserves to $588 billion.

Source: RBI Website

Inflation, combined with currency depreciation, has a double-whammy effect on the economy and consumers. Many Central Banks around the world, including the RBI, have raised interest rates to combat inflationary pressures in raw materials and other commodities. This is also expected to help moderate the Rupee’s value decline. The RBI has also announced a slew of policies aimed at increasing forex inflows while maintaining overall macroeconomic and financial stability.

Disclaimer: “The views expressed are for information purposes only. The information provided herein should not be considered as investment advice or research recommendation. The users should rely on their own research and analysis and should consult their own investment advisors to determine the merit, risks, and suitability of the information provided.”