Do REITs deserve a place in your portfolio?

Real estate investment trusts are like mutual funds, where money is pooled from investors and units are allotted to them, which represent ownership in real estate assets. REITs invest in income-generating real estate properties. These income-generating real estate properties can be residential buildings where flats are rented, commercial office spaces, warehouses, hotels, shopping malls, airports, etc. In India, as of now, only commercial REITs are allowed to do business.

Speaking about India specific, a REIT will raise money from investors and either acquire a developed property or develop a property on its own. Later on, this property is rented to different tenants, which are predominantly corporate entities. The rent collected is then distributed to the unitholders after deducting all the necessary expenses.

Each REIT has a sponsor who acts as a trustee for the unitholders and owns the property on behalf of the unitholders. The day-to-day activities concerning the properties such as choosing the right tenant, negotiating the lease terms with the tenants, maintenance of the properties, etc are handled by a management team (REIT Manager) appointed by the sponsor.

Let’s look at some advantages of considering REITs as an investment:

- Direct exposure to real estate requires a large amount of investment, whereas, REIT units are available at a low-ticket size. Over and above that, an investment through REIT provides diversification benefits, which is difficult to achieve by directly owning properties.

- REITs are highly regulated and are required to distribute at least 90% of the net distributable cash flow to the unitholders. It is also mandatory for a REIT to have at least 80% of its portfolio invested in fully developed properties. This eliminates execution risk to a large extent.

- The dividend distributed by the REIT is often tax-free in the hands of the unitholder. This may not always hold as it depends on the REITs ownership structure.

- As REITs distribute more than 90% of their net distributable cash flow to the unitholders, a REIT acts as a hybrid instrument with regular dividend pay-out and capital gains due to share price change.

- REITs also provide stability to your portfolio as a REIT’s stock price does not fluctuate much because it is valued based on the value of real estate assets it is owning, and real estate prices generally fluctuate less than stock prices.

Although there are no specific disadvantages of having a small exposure to a REIT, here are certain difficulties a REIT, as a business, can face, which will eventually affect the unit price and NDCF:

- Recently in the COVID period, most companies chose work from home over going to the office. In such a situation, there can be lease cancellations or uncertainty about future lease renewals.

- Any economic slowdown results in MNCs laying off employees and in the worst-case scenario, exiting the country. REITs lose business when office spaces are kept vacant for a long period.

These are larger economic issues that will be faced by any other business along with a REIT.

In India, we currently have 3 listed REITs and while the Nifty 50 index is down 6% year to date, the REITs are up from 8.5% to 10.5% for the same period. Investors’ interest has come back to REITs with the opening up of the economy and higher occupancy levels of the office spaces. The only limitation here is that of limited options as there are only 3 REITs and 1 International REIT Fund of Fund in India. This significantly limits the choices for investors.

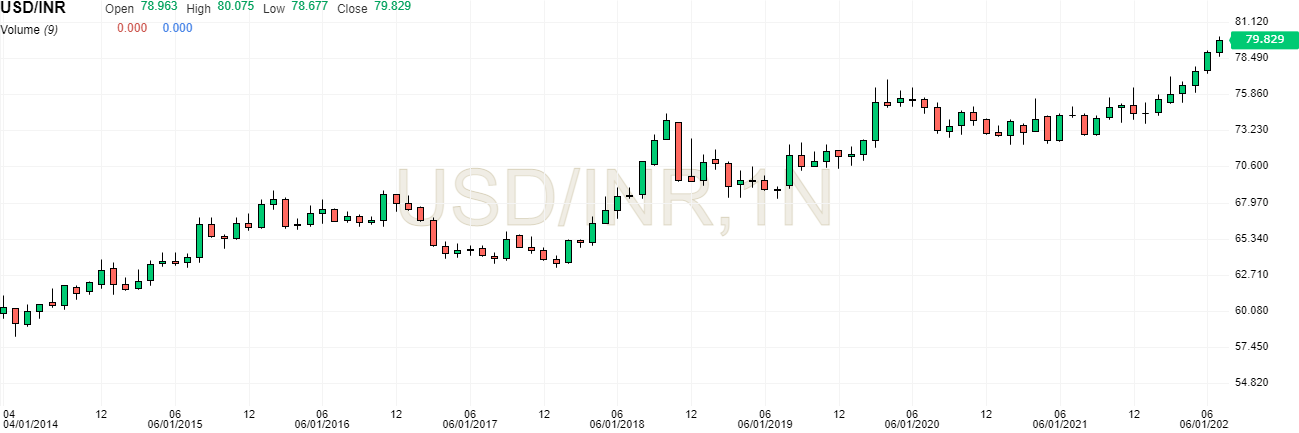

Source: Tradingview

Disclaimer: “The views expressed are for information purposes only. The information provided herein should not be considered as investment advice or research recommendation. The users should rely on their own research and analysis and should consult their own investment advisors to determine the merit, risks, and suitability of the information provided.”

Technical talks

Technical talks